Updated January 2026: At Apideck, we continuously evaluate pricing models to deliver the best value for our customers. Based on client feedback and evolving industry needs, we've shifted from API call-based to consumer-based pricing as our primary model. It's the approach that makes the most sense for how teams actually use unified APIs today. This guide explains why and when other models might still apply.

Managing SaaS products means orchestrating multiple third-party services, including CRMs, payment processors, accounting systems, and HRIS platforms. Each integration demands custom logic, ongoing maintenance, and updates when APIs change. These efforts drain engineering resources and create bottlenecks.

Unified APIs solve this by providing a single standardized interface that consolidates multiple services into one integration layer. Standard endpoints, authentication, and normalized data.

But integration challenges aren't just technical. When pricing models don't match your use case, you get unpredictable costs, opaque billing, and workflows that don't scale. A B2B SaaS platform offering CRM and HRIS integrations may see uneven API traffic across clients. With a rigid pricing model, margins shrink as high-volume clients consume disproportionate resources.

This article breaks down unified API pricing models, explains why consumer-based pricing has emerged as the best option for most use cases, and helps you evaluate what fits your integration strategy.

Common Pricing Models for Unified APIs

Account-Based Pricing

Charges are based on the number of linked accounts, where each connection your customer makes to a third-party service counts as a billable unit. If a customer connects their QuickBooks account, that's one linked account. Connect Xero too, that's two.

The appeal is predictability. You know how many linked accounts you have, so you can forecast costs. But this model has a significant downside: costs scale with connections, not value.

If a customer connects five integrations but barely uses them, you pay the same as a customer who syncs thousands of records daily through a single connection. And costs add up fast, since at typical market rates, 100 customers each connecting 2 integrations means 200 linked accounts. At $50-65 per linked account, that's $10,000-13,000 monthly before you've made a single API call.

This model also creates friction around multi-connector use cases. If your product benefits from customers connecting multiple services, account-based pricing penalizes that behavior.

Tiered Pricing

Predefined payment tiers for different usage levels. Start low, move up as consumption grows. Still get fixed costs, but with scalability built in.

Watch for exponential cost jumps between tiers. Moving up for just a few extra transactions can significantly increase your bill. Requires careful planning to avoid hitting limitations quickly.

API-Call-Based Pricing

Costs tied directly to unified API requests made. Either a price per call or a monthly allocation.

Flexible for variable or unpredictable usage patterns. Pay only for what you use. But high-volume workloads lead to rapidly increasing costs, and that’s the problem. Production integrations sync frequently. They handle substantial data. API-call pricing penalizes exactly the behavior you want: active, well-used integrations.

Consumer-Based Pricing

Charges are based on the number of connected consumers, meaning end users who authenticate integrations, rather than individual API calls or linked accounts. One customer connecting multiple integrations counts as one consumer, not multiple billable units. And you get unlimited API calls within each tier.

This is where the industry is heading, and for good reason.

Why Consumer-Based Pricing Is the Best Model Right Now

After working with hundreds of companies building integrations, a clear pattern emerged: both API-call pricing and account-based pricing create the wrong incentives.

API-call pricing makes teams delay syncs, skip useful data, and build workarounds to reduce call volumes. Account-based pricing discourages multi-connector adoption and charges the same whether integrations are heavily used or dormant.

Consumer-based pricing fixes both problems. Here's why it's the best option for most unified API use cases:

1. Costs Scale With Business Value, Not Technical Activity

With consumer-based pricing, you pay based on how many of your customers use integrations, not how many API calls they generate or how many services they connect.

This aligns costs with actual business value. Ten customers using your integrations is worth more than two. You should pay more. But whether those ten customers sync 1,000 invoices or 100,000, or whether they connect one service or five, that shouldn’t fundamentally change your cost structure because the business value is the same.

Account-based pricing charges more for customers who connect multiple services, even when that's exactly the behavior you want to encourage. API-call pricing charges more for heavier usage even when that usage serves the same number of customers generating the same revenue.

Consumer-based pricing gets the incentives right.

2. No More Optimization Theater

API-call pricing forces engineering teams to spend time reducing calls instead of building features. Batching requests, caching aggressively, delaying syncs, and skipping optional data are all tactics to manage costs.

Account-based pricing forces product teams to limit which integrations they offer or discourage customers from connecting multiple services.

Both are wasted effort. Your teams should build integrations that work well and encourage adoption, not integrations that minimize billable units.

Consumer-based pricing eliminates this. Sync as frequently as needed. Pull all relevant data. Let customers connect as many services as they want. Your costs don't change based on how thoroughly you build or how broadly customers adopt.

3. Predictable Budgeting

Finance teams hate API-call pricing. Usage spikes are unpredictable. A customer onboarding a large dataset can blow through monthly allocations.

Account-based pricing seems predictable until you realize that customers can connect new services mid-cycle, which changes your bill, and you can’t always forecast when that will happen.

Consumer-based pricing is genuinely predictable. You know how many customers have active integrations. Adding connections doesn't change the cost. Syncing more data doesn't change the cost. You can forecast accurately.

4. Encourages Adoption

When customers worry about "using too many calls" or "connecting too many services," they build shallow integrations. They connect fewer services. They sync less data. They update less frequently. They get less value, and so do their end users.

Consumer-based pricing removes this friction. Customers build deeper integrations and connect more services because there's no penalty for doing so. More data synced, more frequent updates, more connectors used, more value delivered.

5. Matches How Production Integrations Actually Work

Real integrations in production sync frequently. They handle large data volumes. Customers often need multiple connectors, such as accounting plus CRM, or HRIS plus payroll.

A company syncing accounting data doesn't sync once and stop. They sync continuously, including new invoices, updated payments, and changed customers. And they often need to connect QuickBooks and their CRM and their payment processor.

Account-based pricing treats multi-connector adoption as a cost problem. API-call pricing treats frequent syncing as a cost problem. Consumer-based pricing treats both as expected, normal behavior for working integrations.

When Other Models Might Still Apply

Consumer-based pricing is the best fit for most production use cases. But other models have their place:

API-call pricing works for early-stage experimentation when usage patterns are unclear and you want minimal commitment. It also fits genuinely low-frequency use cases, such as weekly syncs with small data volumes where you’re paying for actual consumption.

Account-based pricing can work if you have a small number of customers who each need just one integration and you've negotiated favorable per-account rates.

Tiered pricing works when you have clear growth stages and want to lock in rates at each level.

But for the majority of teams building customer-facing integrations that will see regular use across multiple connectors, consumer-based pricing delivers the best combination of value, predictability, and alignment with how integrations actually work.

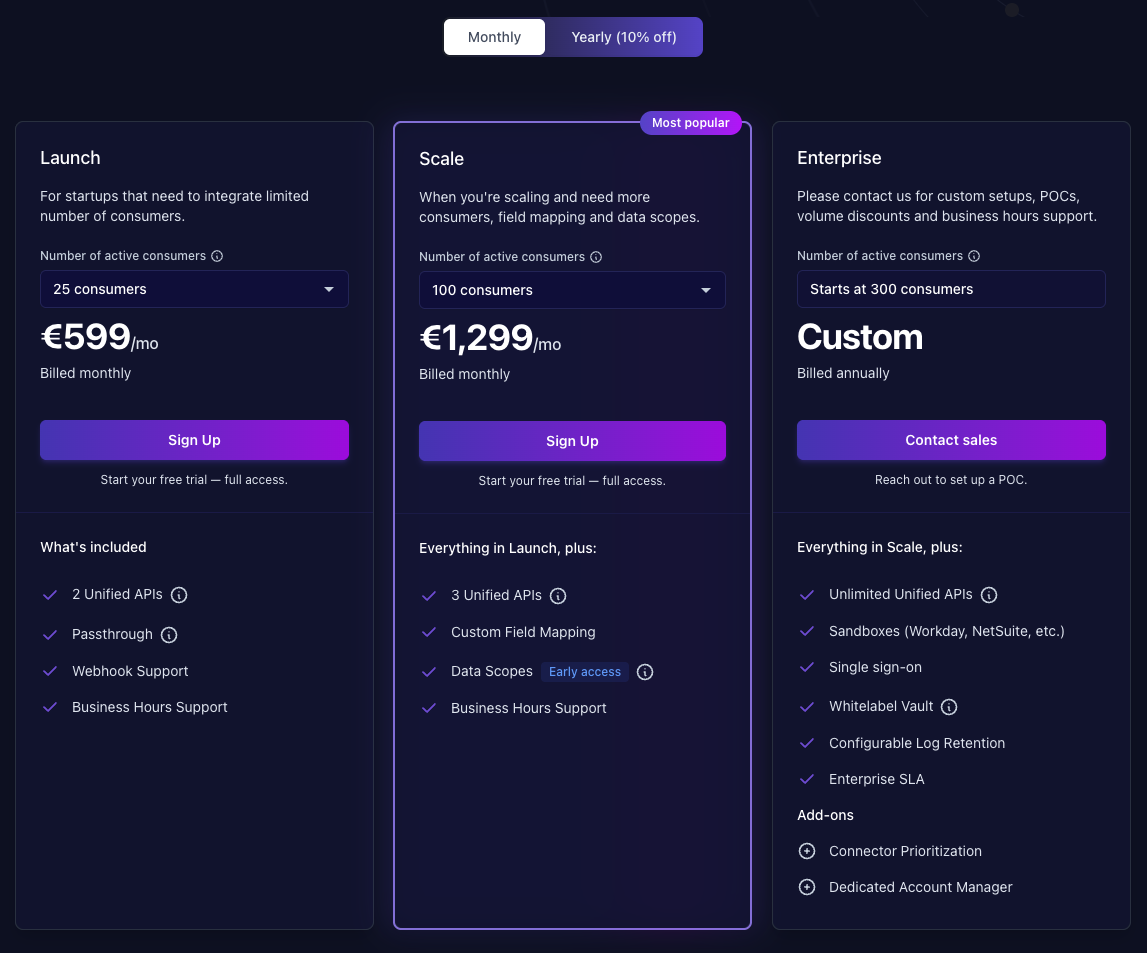

How Apideck Implements Consumer-Based Pricing

Apideck’s pricing is built around connected consumers, meaning the end users who authenticate integrations through your product.

What you get:

-

Unlimited API calls. Sync as frequently as needed. Pull all relevant data. No metering anxiety. \

-

Unlimited connectors per consumer. Customers can connect QuickBooks, Xero, HubSpot, and BambooHR and still count as one consumer, not four linked accounts. \

-

Predictable costs. Know exactly what you'll pay based on connected consumers, not unpredictable usage patterns or connector counts. \

-

Tiered capabilities. Launch, Growth, and Enterprise tiers offer different features, such as the number of APIs, security capabilities, monitoring, and SLAs, so you can pay for what you need. \

-

Full visibility. Real-time monitoring and logs let you track all API calls and data exchanged. Understand usage patterns without being penalized for them. \

For teams with genuinely light or variable usage who prefer granular cost control, API-call-based options remain available. But most production workloads get better value from consumer-based pricing.

Making the Decision

Choose consumer-based pricing if:

- You're building customer-facing integrations that will see regular use

- Your integrations sync frequently or handle substantial data volumes

- Customers benefit from connecting multiple services

- Budget predictability matters to your finance team

- You want engineers focused on building good integrations, not optimizing costs

Consider other models if:

- You're experimenting and usage patterns are genuinely unclear

- Your use case involves infrequent, lightweight syncs with single connectors

- You need tight cost control on highly variable workloads

For most teams building unified API integrations, consumer-based pricing is the right choice. It aligns costs with business value, eliminates optimization theater, encourages multi-connector adoption, and lets you build integrations the right way.

Summary

| Pricing Model | Best For | Limitations |

|---|---|---|

| Consumer-based | Production workloads, multi-connector use cases, budget predictability | May overpay if usage is genuinely minimal |

| Account-based | Single-connector, low-volume use cases | Penalizes multi-connector adoption, costs add up fast |

| API-call-based | Experimentation, low-frequency syncs | Penalizes active usage, unpredictable costs |

| Tiered | Clear growth stages | Cost jumps between tiers |

Next Steps

Apideck provides unified APIs across accounting, HRIS, CRM, ATS, file storage, ecommerce, and more. Consumer-based pricing lets you build integrations the right way, with unlimited calls and unlimited connectors per customer, without worrying about billable units. Start your free trial today and build with confidence: full platform access + 2,500 free API calls included.

Ready to get started?

Scale your integration strategy and deliver the integrations your customers need in record time.