Company Background: who is OCTA?

Founded in early 2024, OCTA is an AI-powered finance automation platform serving SMEs and enterprises across the Middle East, with a strong presence in the UAE and Saudi Arabia. OCTA’s mission is to help finance teams eliminate operational drag, solve cash flow challenges, and get paid faster.

The platform automates the entire contract to cash cycle, from contract generation and invoicing to reconciliation and collections. It syncs seamlessly with CRMs, ERPs, and accounting tools to connect sales, finance, and operations.

At the foundation of the platform:

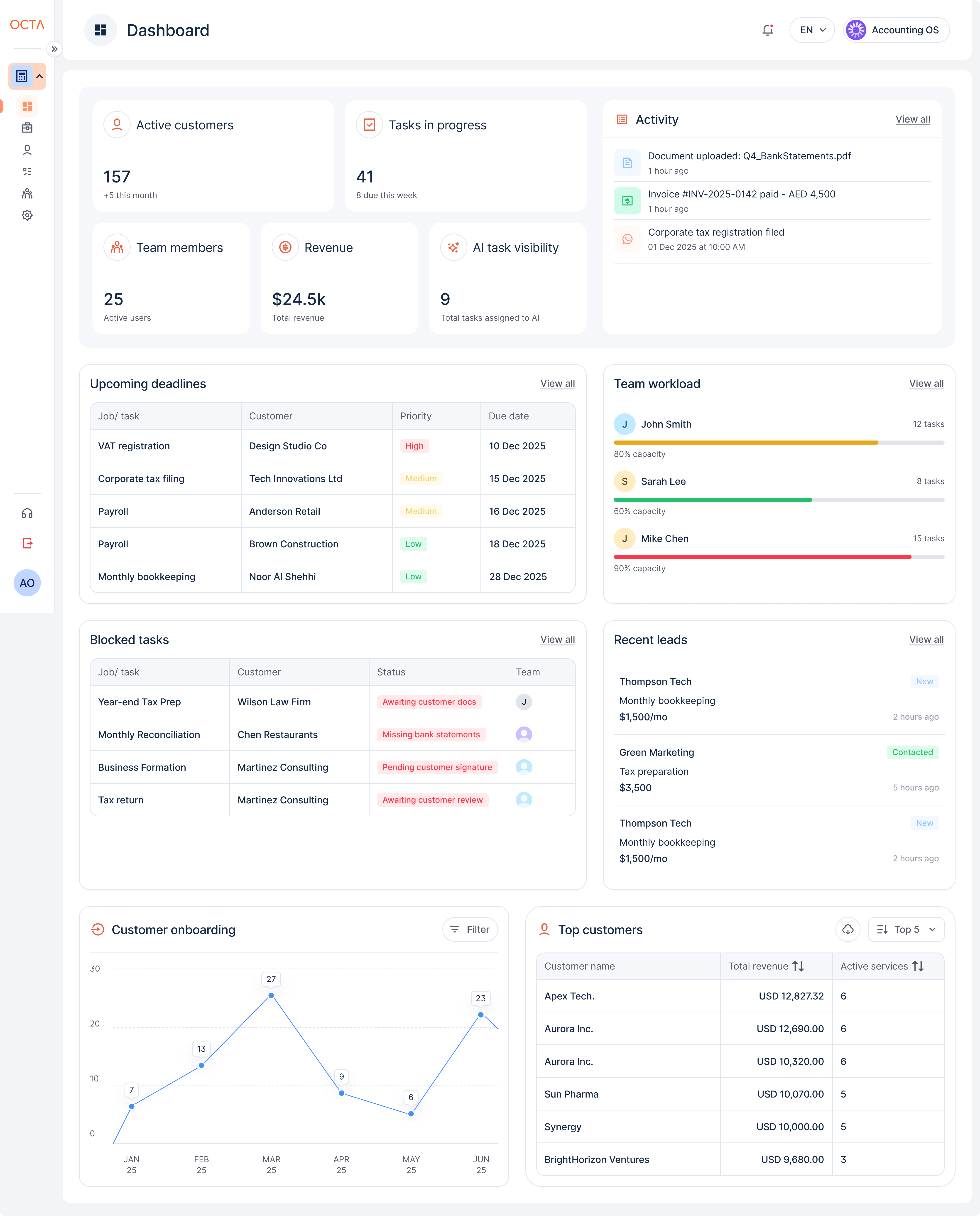

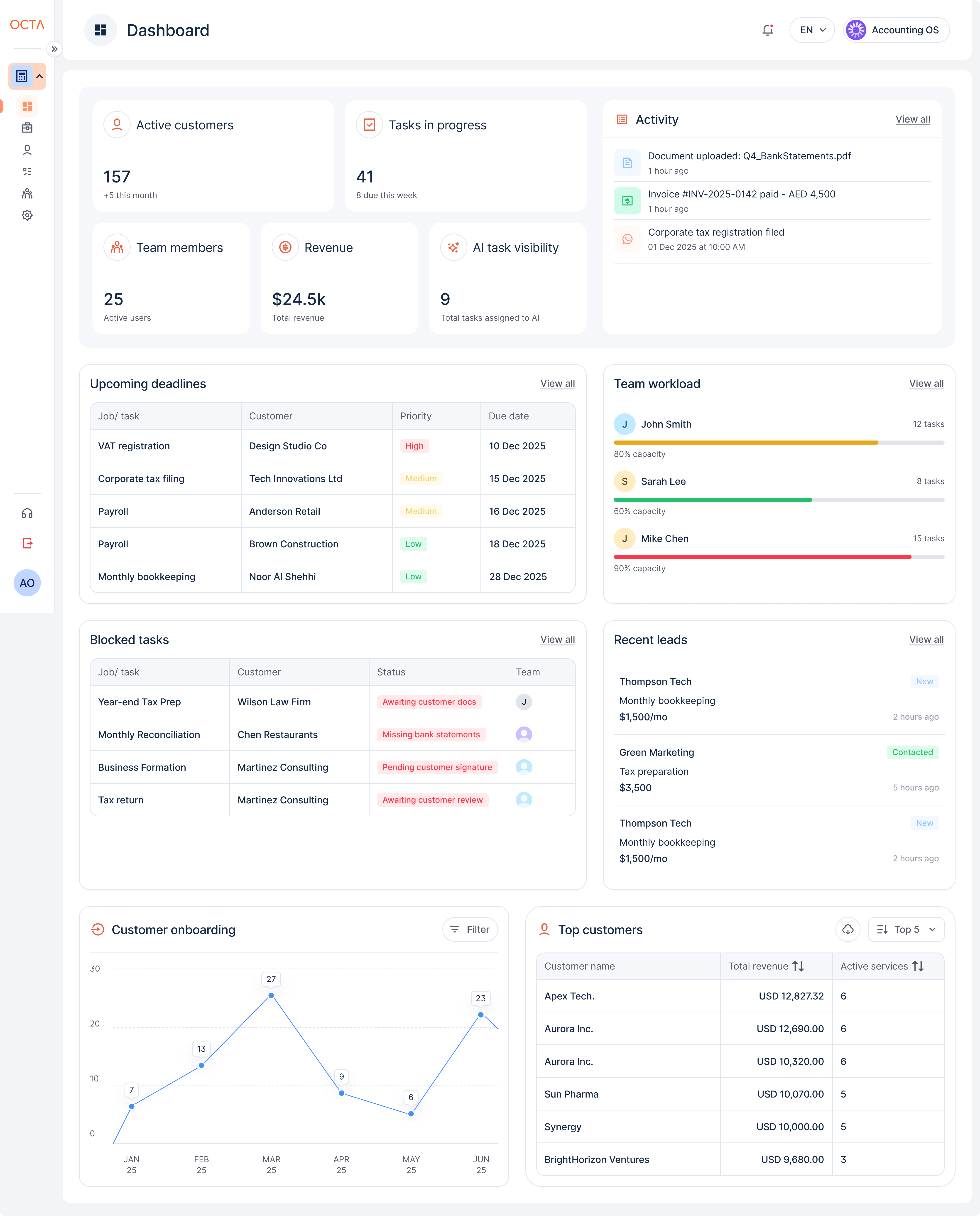

OCTA Core structures receivables, payables, contracts, and reconciliation in one connected system

OCTA Flow powers accounting, audit, and advisory firms with workflows that run on their own

AI Agents automate follow-ups, track risk, sync data, and ensure nothing slips through the cracks

OCTA enables finance teams and service firms to move faster, reduce risk, and operate with clarity, bringing finance with intelligence to the region’s most ambitious businesses.

The Challenge: The Startup Integration Trap

As an early-stage startup, OCTA faced significant uncertainty regarding which tech stacks their potential customers were using. They needed to connect with a wide variety of CRMs and accounting software without the capacity to build dozens of native integrations in-house.

The primary market motivations included:

- Speed to Market: OCTA needed to test the waters quickly across multiple systems without the long development cycles of building native integrations.

- Resource Constraints: With only two engineers at the start, hiring specialists for every unique platform (like Salesforce or Oracle Fusion) was not financially or operationally feasible.

- Security & Compliance: Handling sensitive finance data meant they needed a solution that met rigorous security standards to ensure customer trust.

The Solution: Speed and Support with Apideck

OCTA chose Apideck after discovering them via LinkedIn and finding that their library covered the specific tech stacks required for the Middle East market. The flexibility of Apideck's pricing model was a decisive factor — allowing a company to start small and scale.

The results of the implementation were immediate:

- Rapid Deployment: OCTA shipped its first integration in just 4–5 days with only two engineers.

- Sales Impact: Having a ready-made connector library allowed OCTA to sign early contracts (including a major Salesforce client) that secured their first significant revenue inflows.

- Engineering Efficiency: The OCTA team integrated complex systems without prior expertise, saving significant time and specialized hiring costs.

- Responsive Support: Apideck's direct Slack support was critical, once adding a missing accounting field within days to unblock a core automation feature.

What's Next: From AR to Full Finance Automation

OCTA experienced massive growth in 2025, expanding its base by 8x. Moving forward, the company plans to move beyond Accounts Receivable (AR) to provide a full-stack finance automation suite that includes Accounts Payable (AP).

OCTA will continue to leverage Apideck’s 2026 roadmap—which focuses heavily on finance and ERP connectors like bank feeds and payment functionalities—to support this regional expansion and product evolution

OCTA will continue to leverage Apideck’s 2026 roadmap—which focuses heavily on finance and ERP connectors like bank feeds and payment functionalities—to support this regional expansion and product evolution

For anyone who's looking to do a faster integrations to multiple systems and with security at affordable pricing... it's a no-brainer.